PlayStation Plus: Can PlayStation triumph over the Xbox Game Pass?

Key Findings

Xbox Game Pass has seen significant subscriber growth since 2020.

Total Players increases massively when a game moves to Game Pass

User Acquisition is still relevant even when a game has already been on Xbox Game Pass.

Day One releases on Game Pass are proving to be popular.

Game playtime drops significantly after joining a subscription service

Back in 2013, Xbox One positioned itself as an entertainment hub rather than a games console - this turned out to be a crucial mistake and one they had to revert due to the backlash from consumers. Microsoft realised they had to make a change and the vision was a games rental service: Xbox Game Pass. With new game prices rising to over £60, it is no wonder this membership platform is appealing to players - especially with the promise of platform exclusives, AAA games and Day One releases. As the primary goal in the console wars becomes who can maintain and grow their Monthly Active Users (MAU), these are the tools both PlayStation and Xbox are relying on.

Xbox has been gaining on PlayStation in recent times and clawing its way back with console sales since the dreaded ‘Xbone’ as shown by VGChartz. Xbox X|S even outperformed PS5 within February of this year. PlayStation’s reactive move is the new and improved PlayStation Plus (PS+), and so in this blog we will take a look at both console's subscriptions as they currently stand and investigate how inclusion on these services impacts player engagement.

The New PS+

PlayStation has unveiled a new PlayStation Plus subscription service that combines the former PS+ and PlayStation Now (PS Now) to rival the Xbox Game Pass. The new service, releasing 23rd June in Europe and already live in the US, is split into 3 tiers - Essential, Extra and Premium:

Table 1: PlayStation Services breakdown of features and pricing.

Will the innovation to the revised PS+ be able to compete against the Xbox Game Pass?

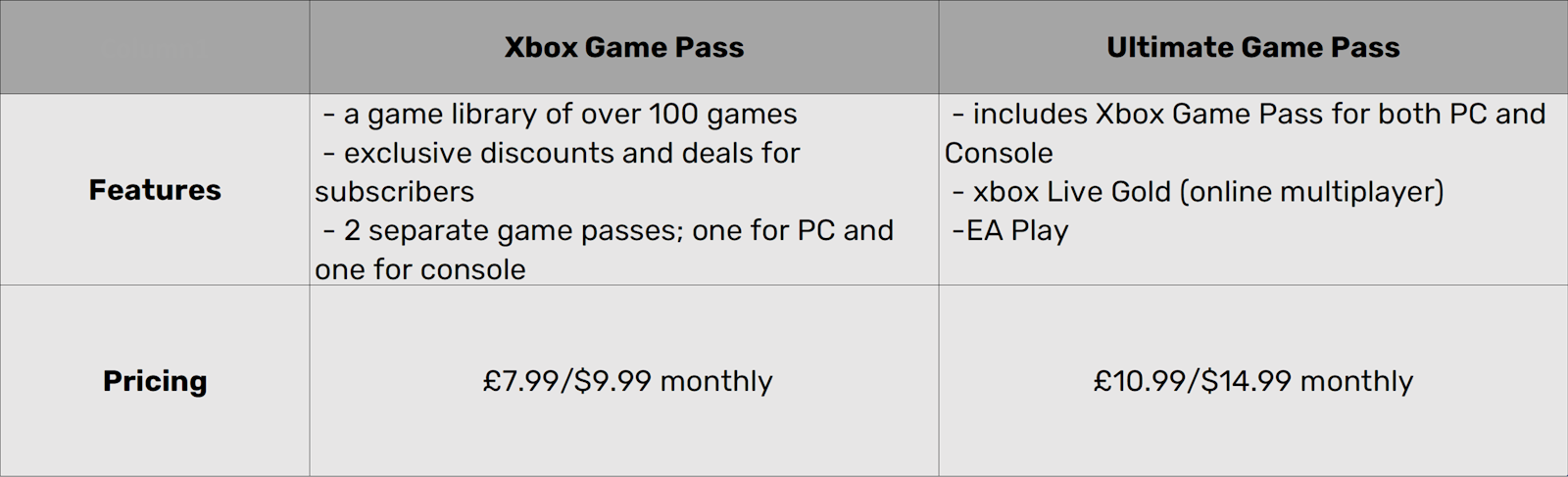

Xbox Game Pass offers a different service to PS+ as it does not contain online multiplayer in the original Game Pass, but there is an option to upgrade to Ultimate which offers more than the default Game Pass:

Table 2: Xbox Game Pass breakdown of features and pricing.

The question on everybody's minds is whether this new PS+ will be able to compete with Xbox Game Pass? In recent years Xbox Game Pass has truly prospered, seeing accelerated growth during lockdown. Has PlayStation missed the opportunity of the same growth? In the rest of the article we will explore the two platforms as they stand currently, and put forward some thoughts on what to expect from PS+.

First we will take a look at how the existing services stack up in subscriber counts.

Subscribers

Xbox released Game Pass back in 2017 and thanks to occasional reported numbers, we can study the service’s growth.

Figure 1: Public data released by Microsoft for the Xbox Game Pass numbers.

Clearly Xbox Game Pass has been showing solid growth with no signs of slowing down after doubling the amount of subscribers in less than 2 years.

In order to compare PlayStation subscription services like-for-like, we need to evaluate the old PS+ and PS Now. PS Now is a cloud-based service which has a library of over 700 games available to download, similar to Xbox Game Pass in that you only own these games as long as the subscription is active.

In comparison, PS+ is a separate service offering online multiplayer and selection of free games each month that subscribers can download and keep forever. These two services will become obsolete when the new PS+ drops.

Figure 2: Public data released by Sony for the current PS+ subscriber numbers.

PS Now numbers are not reported as frequently but from released data we know that between October 2019 and March 2021 subscribers rose from 1 million to 3.2 million.

Table 3: Xbox and PlayStation Subscription numbers and yearly growth rate.

Inclusion on these subscription services is an opportunity for a game to reach a market of gamers who might otherwise not have checked it out. We will look into a few different metrics for player engagement, to observe the impact on this on some specific game examples and compare Xbox and PlayStation's services.

Total Players

Firstly, we will measure the impact of a game going free on Game Pass/PS Now and how that can affect total players. Of course a game going free will increase the player base but is this effect the same for both subscriptions, and are there any other factors that impact the Game Pass/PS Now effect? We'll take a look at some examples to explore this.

For example, Figure 3 shows the total players data for It Takes Two. Note that on these graphs, 'On Xbox' and 'On PlayStation' mean available to buy, but not free to play on any service.

Figure 3: Total Players on Xbox and PlayStation for It Takes Two.

The game was showing stronger numbers on PlayStation up until its release on Xbox Game Pass. At this point Xbox growth skyrocketed, quadrupling total players in 4 months, and overtaking PlayStation in Jan 2022.

Even in cases when a game joins Game Pass late on in its lifetime, it can help bridge the gap between Xbox and PlayStation - this is seen in the player trends for Mortal Kombat 11, seen in Figure 4:

Figure 4: Lifetime Players on Xbox and PlayStation for Mortal Kombat 11

Interestingly, when the game joined PS Now it did not appear to affect its players by any noticeable amount - perhaps it joined too late, or the game is too large in relation to the small amount of PS Now subscribers to see the impact. If current trends continue, Xbox players may overtake PlayStation players in the future.

We've seen the effect of joining Game Pass after launch, but what does a Day One release look like? There are increasingly more games releasing straight to Xbox Game Pass. With Game Pass as popular as it is, studios may even be in profit for a game even before it has been released. Gamers benefit from the latest release without paying a premium to own the game or waiting months or years (?!) for a discount.

A recent example of a Day One Game Pass inclusion is Back 4 Blood:

Figure 5: Lifetime Players on Xbox and PlayStation for Back 4 Blood

In the case of Back 4 Blood, the player numbers for Xbox clearly dwarf those for PlayStation - currently about 10 times as many players. We'll explore how Game Pass joiners retain in the next section, but the user acquisition benefits are clear.

Shadow Warrior 3 is the first time Sony has released a Day One launch on PlayStation Now. Figure 6 shows the comparison to Xbox:

Figure 6: Lifetime Players on Xbox and PlayStation for Shadow Warrior 3

In its first month and a half, the game saw 5x as many players on PlayStation as on Xbox - in comparison, Back 4 Blood was already seeing 10x the players on Game Pass as PlayStation in the same amount of time into its release (especially impressive given PlayStation as a platform is 1.5-2x the size of Xbox by user count). With PS Now having a fraction of the subscribers Game Pass has, it raises the question how well this service could do if it had bigger games available Day One, as Game Pass does.

Sony choosing such a small game as their debut Day One release makes sense - as discussed here by Gamerant, the scale of Sony compared to Microsoft explains why Sony might not be able to afford AAA releases Day One. Sony CFO Hikori Totoki explains that to afford putting AAA games on PS+ Day One, cutbacks to investment in the game's production would deteriorate the game quality. On the other hand with Microsoft being a much larger company financially they can afford this investment, even making large scale acquisitions such as Activision giving them more control over the market. Perhaps if the new PS+ is a success, Sony will be able to make the step towards larger Day One inclusions- we shall have to wait and see…

Another situation we can study is when a game leaves Game Pass and later returns - Outer Wilds is an example of this:

Figure 7: Outer Wilds Lifetime Players on Xbox and PlayStation

Growth more or less plateaued when the game was taken off Game Pass, and when it returned the growth rate quickly caught back up. The period of time off Game Pass hasn’t affected the player total it is at currently - it saw a 22% growth in players on its first month back on the service and regained the previous trend. Outer Wilds success reappearing after 8 months suggests Xbox can continuously recycle games onto the Game Pass. The game was also released on PS Now in April 2022, experiencing a 40% increase in players in the first month.

We've seen the benefits of Game Pass/PS Now for user acquisition, but how engaged are these acquired users? We'll explore this through playtime data.

Playtime

When a game joins Game Pass/PS Now, or is given away free on PS+, it will typically see a drop in average playtime of its players. Figure 8 shows the percentage drop for each platform:

Figure 8: Percentage drop in average playtime from the month before to the month after a game joins a service.

A 61% decrease for Game Pass, and a lower (but still significant) 49% for PS+/PS Now. This result is evidence that the newly acquired players through these services are less invested in the game compared to those who specifically bought a copy, not an unexpected result. Developers will need to decide whether the user acquisition benefits are worth the less retentive player base.

Certain games see a severe drop off in playtime, for example Marvel’s Guardians of the Galaxy experienced a big drop off in playtime with 2.9 million new players after being added to Xbox Game Pass but dropped in playtime by 80%. In the same time period, on PlayStation it had 47k new players but playtime dropped around 1%.

The trade-off between user acquisition and enthusiastic players needs to be considered. Battlefield 2042, although not on Game Pass, has an issue with acquiring and retaining players, leading to poor matching-making resulting in the 128 player-mode being dropped. Does the high user acquisition on Game Pass prevent games from the same fate, or is low user enthusiasm too much of an issue?

Active Players

Figure 9: Percentage of Active Players for games that have gone to Xbox Game Pass

All three games saw a surge in active user percentage, before dropping. Mortal Kombat 11 seems to have had a delayed effect - perhaps the influx of new gamers during the Christmas season overshadowed its Game Pass inclusion this month.

Active user numbers appear to stabilise near the levels they were before Game Pass, suggesting that while a lot of new users might be acquired through Game Pass, games will see a similar number of dedicated players than they would have done without Game Pass.

Joining Game Pass can affect games differently depending on their size as well. Calculating the month after Game Pass release for February additions, active players increased by an average of 4000%, however NFL Madden 22 which already had quite an active player base only saw a 34% increase. In comparison, the lesser known Contrast saw an active players increase of 5250%.

Summary

Since 2020, Xbox has been starting to close the gap between console sales and trying to achieve parity with PlayStation, thanks largely to the Xbox Game Pass. Total players and percentage of active players see a huge increase when a game is moved to the service, though the latter does not seem to last long. There are also concerns around playtime - a player is not as invested as they have not spent any money, and so are less active and less retentive.

PlayStation has already tested the games on demand format with PS Now, but it is yet to be seen how the revamped PS+ will fare. While Day One acquisitions don't seem to be on the table for the moment, time will tell whether PlayStation will be able to keep up or if Xbox Game Pass model is the future of console gaming.

In the context of competing platforms striving to maximise their Monthly Active Users (MAU), the Activision Blizzard acquisition has highlighted where PlayStation must compete with Xbox. PlayStation needs to focus on more opportunities to control the content, such as the recent one with Bungie, as the future is looking competitive to get serious, multiplayer titles on their platform - titles that will provide the persistent active users they desperately need to redress the widening power imbalance.